Memorial Donations

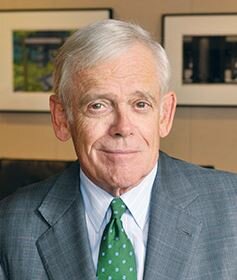

Obituary of William H. Donaldson

William H. Donaldson, 93 years old, died at home in Waccabuc, N.Y. on June 12, 2024. The cause was leukemia. Bill was born and raised in Buffalo, New York. He attended the Nichols School and then Yale University, where he was business manager of the Yale Daily News, played freshman ice hockey, and earned a B.A. in American Studies in 1953. After graduation, he joined the U.S. Marine Corps and became a first lieutenant in the Far Eastern Theatre (Japan-Korea).

Bill earned an MBA in 1958 with distinction from the Harvard Business School. In 1959, Bill and two friends from business school, Dan Lufkin and Dick Jenrette, co-founded the investment banking firm of Donaldson, Lufkin & Jenrette. DLJ became the first NYSE firm to sell its shares to the public, a move that reflected their willingness to disrupt the status quo. In a 2001 Institutional Investor article, Justin Schack writes, “DLJ effectively transformed a genteel Wall Street club into a marketplace of ideas.” Bill was selected as Businessman of the Year by the Associated Press in 1970.

In 1973, Bill accepted an offer from Secretary of State Henry Kissinger to become Under Secretary of State for International Security Affairs. After Nixon resigned in 1974, Bill went to the White House to serve as counsel to the newly appointed Vice President Nelson Rockefeller.

In 1975 Bill was asked by then President of Yale, Kingman Brewster, to launch a new and unique graduate management school for his alma mater that would help bridge the gap between the public and private sectors. He became the Founding Dean of the Yale School of Management, a role he cherished. Having established SOM, Bill then returned to Wall Street in 1980 to start an international investment fund, Donaldson Enterprises.

In 1990, he was asked to serve as Chairman and CEO of The New York Stock Exchange. He relished the opportunity to upset the status quo yet again, keeping the exchange competitive by adding new technology and listing a record number of foreign companies. He appreciated the irony of leading the institution that had originally rejected his plan to make DLJ the first NYSE listed firm to offer its shares to the public.

Five years later after completing his term at the NYSE, Bill, a Director of the then troubled Aetna, agreed to become their CEO. Within two years he had turned the insurance company around, overcoming ill-advised acquisitions, class-action lawsuits, and government cost cutting measures.

In 2003, President George W. Bush appointed Bill, at the age of 72, as the 27th Chairman of the Securities and Exchange Commission. Bill saw that period at the SEC as an opportunity to restore the integrity and purpose of a vital institution that was at an inflection point. Under his watch, the SEC entered into one of its most transformative eras since the Agency’s founding during the Great Depression.

Bill served as a Director of 14 publicly held corporations and a number of privately held businesses. He served on the boards of numerous philanthropic, arts and educational institutions.

While Bill thrived on the opportunities and challenges in his public life, he deeply appreciated his time spent with family and close friends. He almost never missed a Yale, Harvard or Nichols reunion. He loved a good game of tennis, reading the biographies of people who shaped this country (and the occasional spy novel), swimming in the ocean, and joining in with whatever family activity was front and center. He loved spending time in Bermuda at the Coral Beach Club, where he played backgammon, occasionally encouraging an unsuspecting opponent to have a Stinger or two with him. He was a wonderful storyteller and loved American and military history. His children grew up learning about what “entrepreneur” meant, as well as the deep importance of giving back.

Bill has been described by friends, colleagues, and family over the years as entrepreneurial, wise, deeply loyal, tenacious, visionary, charismatic and always ready to honor a handshake agreement. He was also charming and fun – however, only his oldest friends and family knew he was a passionate yodeler. Perhaps his most memorable trait, however, was his respect for people. He always looked directly at someone and truly listened to what they had to say. There was a twinkle in his eye that made anyone feel comfortable. He had that twinkle until the end of his days. Through all of his accomplishments, he remained true to himself.

Bill is survived by his wife, Jane Phillips Donaldson, his three children, Kimberly Donaldson (Eric Mark), Matthew Donaldson, and Adam Donaldson (Kim Borza Donaldson), and three grandchildren, Lars Kikoski, Will Donaldson, and Henrik Mark.

A celebration of Bill’s life will be held in the fall.

In memoriam gifts may be made to the William H. Donaldson Scholarship and Loan Forgiveness Fund at Yale SOM. Yale School of Management Office of Development,

2 Whitney Ave. 3rd Floor, New Haven, CT 06511 203-432-1705.

William H. Donaldson, 93 years old, died at home in Waccabuc, N.Y. on June 12, 2024. The cause was leukemia. Bill was born and raised in Buffalo, New York. He attended the Nichols School and then Yale University, where he was business manager of the Yale Daily News, played freshman ice hockey, and earned a B.A. in American Studies in 1953. After graduation, he joined the U.S. Marine Corps and became a first lieutenant in the Far Eastern Theatre (Japan-Korea).

Bill earned an MBA in 1958 with distinction from the Harvard Business School. In 1959, Bill and two friends from business school, Dan Lufkin and Dick Jenrette, co-founded the investment banking firm of Donaldson, Lufkin & Jenrette. DLJ became the first NYSE firm to sell its shares to the public, a move that reflected their willingness to disrupt the status quo. In a 2001 Institutional Investor article, Justin Schack writes, “DLJ effectively transformed a genteel Wall Street club into a marketplace of ideas.” Bill was selected as Businessman of the Year by the Associated Press in 1970.

In 1973, Bill accepted an offer from Secretary of State Henry Kissinger to become Under Secretary of State for International Security Affairs. After Nixon resigned in 1974, Bill went to the White House to serve as counsel to the newly appointed Vice President Nelson Rockefeller.

In 1975 Bill was asked by then President of Yale, Kingman Brewster, to launch a new and unique graduate management school for his alma mater that would help bridge the gap between the public and private sectors. He became the Founding Dean of the Yale School of Management, a role he cherished. Having established SOM, Bill then returned to Wall Street in 1980 to start an international investment fund, Donaldson Enterprises.

In 1990, he was asked to serve as Chairman and CEO of The New York Stock Exchange. He relished the opportunity to upset the status quo yet again, keeping the exchange competitive by adding new technology and listing a record number of foreign companies. He appreciated the irony of leading the institution that had originally rejected his plan to make DLJ the first NYSE listed firm to offer its shares to the public.

Five years later after completing his term at the NYSE, Bill, a Director of the then troubled Aetna, agreed to become their CEO. Within two years he had turned the insurance company around, overcoming ill-advised acquisitions, class-action lawsuits, and government cost cutting measures.

In 2003, President George W. Bush appointed Bill, at the age of 72, as the 27th Chairman of the Securities and Exchange Commission. Bill saw that period at the SEC as an opportunity to restore the integrity and purpose of a vital institution that was at an inflection point. Under his watch, the SEC entered into one of its most transformative eras since the Agency’s founding during the Great Depression.

Bill served as a Director of 14 publicly held corporations and a number of privately held businesses. He served on the boards of numerous philanthropic, arts and educational institutions.

While Bill thrived on the opportunities and challenges in his public life, he deeply appreciated his time spent with family and close friends. He almost never missed a Yale, Harvard or Nichols reunion. He loved a good game of tennis, reading the biographies of people who shaped this country (and the occasional spy novel), swimming in the ocean, and joining in with whatever family activity was front and center. He loved spending time in Bermuda at the Coral Beach Club, where he played backgammon, occasionally encouraging an unsuspecting opponent to have a Stinger or two with him. He was a wonderful storyteller and loved American and military history. His children grew up learning about what “entrepreneur” meant, as well as the deep importance of giving back.

Bill has been described by friends, colleagues, and family over the years as entrepreneurial, wise, deeply loyal, tenacious, visionary, charismatic and always ready to honor a handshake agreement. He was also charming and fun – however, only his oldest friends and family knew he was a passionate yodeler. Perhaps his most memorable trait, however, was his respect for people. He always looked directly at someone and truly listened to what they had to say. There was a twinkle in his eye that made anyone feel comfortable. He had that twinkle until the end of his days. Through all of his accomplishments, he remained true to himself.

Bill is survived by his wife, Jane Phillips Donaldson, his three children, Kimberly Donaldson (Eric Mark), Matthew Donaldson, and Adam Donaldson (Kim Borza Donaldson), and three grandchildren, Lars Kikoski, Will Donaldson, and Henrik Mark.

A celebration of Bill’s life will be held in the fall.

In memoriam gifts may be made to the William H. Donaldson Scholarship and Loan Forgiveness Fund at Yale SOM. Yale School of Management Office of Development,

2 Whitney Ave. 3rd Floor, New Haven, CT 06511 203-432-1705.